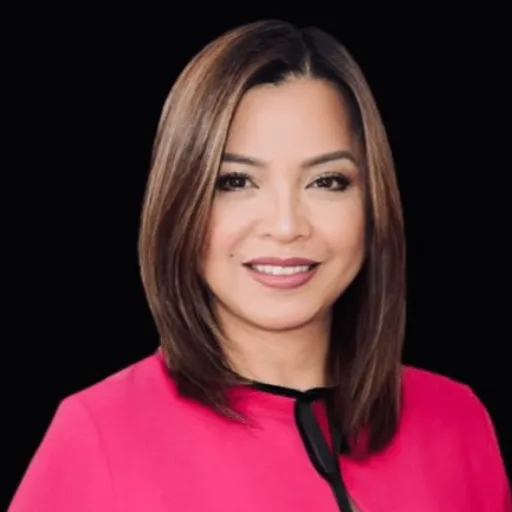

About Wilma

I'm Wilma, your guide to building wealth through investment in real estate. Whether you're buying your first home, a second property, or investment property, let me ensure you get the best mortgage for you! Mortgage financing doesn't have to be difficult, let me walk you through the process.

As your independent mortgage professional, I'm happy to provide you with mortgage options. I will assess your financial situation, listen to your goals, and suggest mortgage products that help get you there. It would be a pleasure to work with you.

Broker Advantage

I work for you, not the bank. Discover all your options today, at no cost to you.

GET PRE-APPROVED

Complete an online application, and a licensed Mortgage Expert will help determine your maximum purchase price. This way, you'll be prepared when that perfect home pops up!

Ready To Buy

Found a home and ready to get fully approved? We're here to assist you right away with quality service and fast approvals. With access to numerous lenders, we can help secure the best rate and product for you!

Access Equity

Considering tapping into your home's value for some extra cash? Leveraging your home equity is a smart way to bring together debts or secure funds for significant purchases or expenses. Dive in to learn more about the possibilities!

Renewal Options

If your mortgage is up for renewal in the next six months, now's the time to explore your options. While your lender will send a renewal offer, we can also explore the market to find you a better interest rate or product. Let's make sure you're getting the best deal possible!

testimonials

Frequently Asked Questions

What is a pre-qualification?

A pre-qualification is when you provide generalized information to a lender or online calculator, without the information being confirmed, and receive an estimated max purchase price.

What is a pre-approval?

A pre-approval is when a qualified mortgage professional reviews the information provided, such as your mortgage application, income & down payment documents, along with verifying your credit bureau to provide you with a more accurate max purchase price.

What is an approval?

After you have an accepted offer to purchase your dream home, your Mortgage Broker will submit your information to a lender. Once the lender reviews & confirms all the information provided, they will provide you with a full approval.

How much can I qualify for?

If you're buying an owner-occupied property, you may be eligible to put as little as 5% down. It's important to note that while the minimum down payment is 5%, you still need to qualify for the total mortgage amount, which is based on your income and debts. Keep in mind that the rules change for a purchase price above $500,000. In such cases, you will require 5% on the first $500K and 10% on the remainder (up to $1M). For homes over $1M, a minimum of 20% down is required. If you're purchasing a rental property, a minimum of 20% down is also necessary.

Should I got with a variable or fixed rate mortgage?

Choosing between fixed and variable rates? A fixed mortgage offers stable payments over a set term, ideal for budgeting. Yet, consider penalties and your long-term goals. Variable rates fluctuate with Prime, great in falling rates, riskier in rising markets. Guarantee consistency with a fixed rate for staying put, explore variable for flexibility. Connect with our experts for guidance!

What is a co-signer?

A co-signer is usually added to your application when you don't qualify for a home on your own. Their income and debts are included to assess if it enhances your overall approval. When someone co-signs, they become part of the mortgage title and documents. This new mortgage debt reflects on their credit bureau, potentially affecting their future credit score and loan affordability.

Copyright © 2025 Wilma Payne Mortgages.

All rights reserved.

Wilma Payne

Mortgage Broker,

BRX Mortgage,#13463